WHAT WE DO

Suite2Go look to connect world class fintech solutions to solve financial industry problems while saving time and cost for both buyers and sellers.

THE PROBLEMS WE HELP SOLVE

Cashflow reporting

Unit pricing

Asset Valuation verification

Liquidity management

APRA reporting

ASIC reporting

Risk reporting

Economic reporting

Fee Calculations

Automation of rebates

Performance fees

Invoicing and client billing

AI for administration

Data quality

Chess replacement

Shareholder reporting

Charting

Economic reporting

Workflow

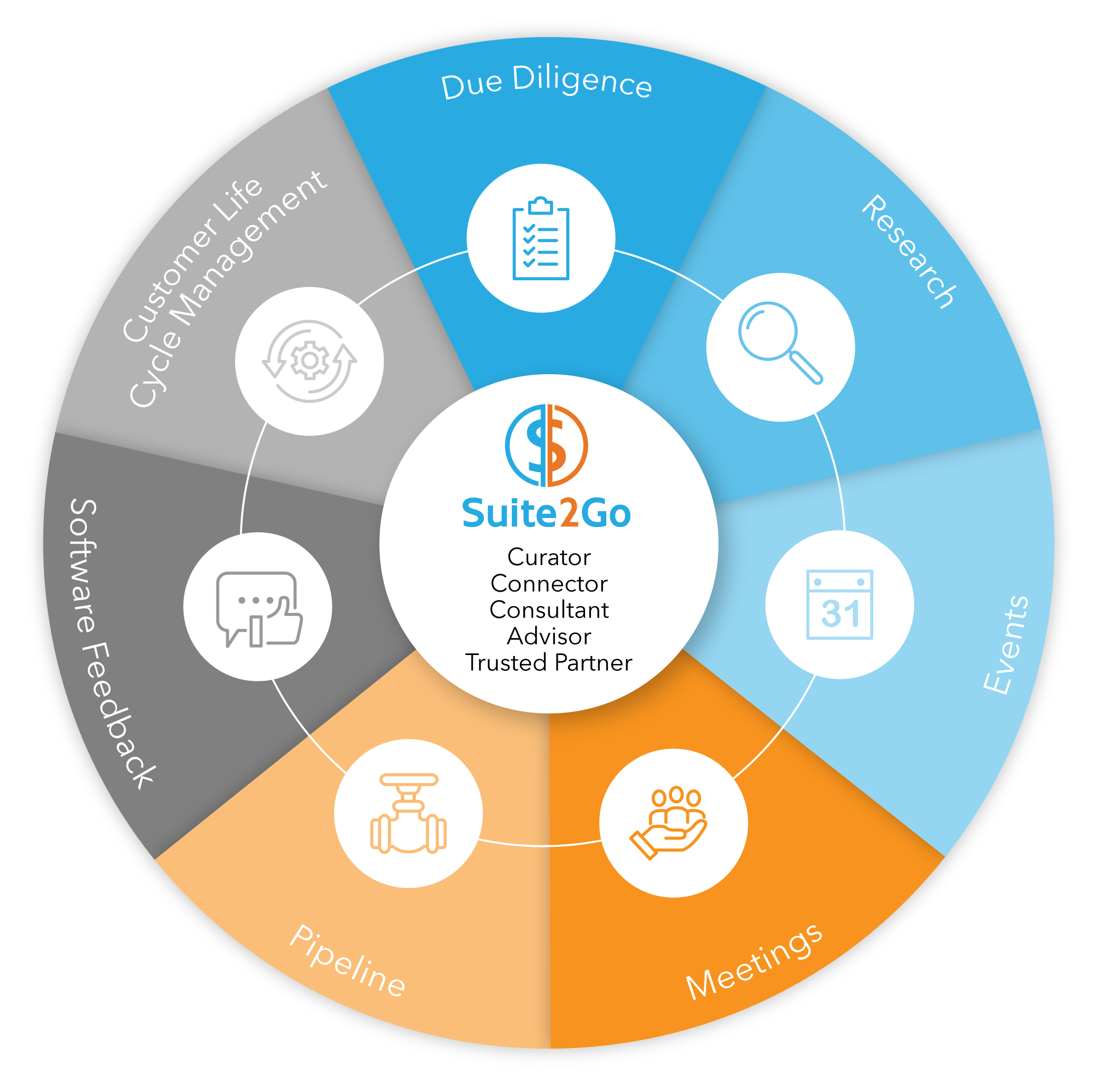

OUR PROCESS

Suite2Go provides a smooth experience for buyers and sellers of financial service software from initiation, understanding the problem (research, strategy, round table and workshops) to procuring the solutions (curation, demos, proof of concept) to implementation and production (project management, account management) as a trusted partner.

Our 7-Step Engagement Process

Due Diligence

reduces the time for buyers to make decisions. As the industry’s trusted partner, we only represent systems which are world class and can adapt to the Australian market nuances. Potential buyers of the software can take comfort that the system has been through a rigorous process prior to coming to the market.

Research

enables vendors to obtain a quick understanding of the local market and the relevant channel segments and their needs. The research conducted is also useful information for buyers of software, as it highlights some of the common issues within the industry.

Events

connects the financial services industry with thought leaders in the fintech sector, while also enabling discussion to solve industry wide issues. Events include roundtables, webinars and participation in relevant industry conferences.

Meetings

a deeper understanding of each channel and specific clients and their business challenges. We do not lead with solutions the aim is to first understand each client, their business, and the problems they are looking to solve.

Pipeline

as we work with our clients, we gain a better understanding of their main challenges and where technology can help improve their business. We can then introduce them to specific vendor solutions. Once a need is identified it is only then that a demonstration of the software is offered.

Software feedback

we use software demonstration sessions as a way to not only demonstrate how a specific technology may help eliminate a business challenge but also gain meaningful feedback on how the latest fintech solution may need to be enhanced to address specific local issues.

Customer life cycle management

as we connect clients with specific vendor solutions, we gain an intimate understanding of the businesses we are working with and our consulting can be extended to provide project management of Proof of Concept, and implementation. Many of our clients also choose to use us for ongoing client relationship management.